Key takeaways

- Confidence to move has returned after Autumn Budget uncertainty, with buyer demand tracking in line with 2024

- Average mortgage rates reach lowest level since 2022, fuelling desire to move

- UK house prices have risen 1.2% in the last year, varying from -2.6% to +5.5% across major cities

- Higher housing supply gives buyers more choice and makes pricing even more important for those thinking of selling.

After a weak end to 2025, confidence is returning as mortgage rates ease and those who delayed decisions last year return to the market.

The first few weeks of the year have seen buyer demand fall short of the very strong start to 2025 when buyers were rushing to beat the stamp duty deadline.

Market conditions vary across the country and are defined by the level of choice for homebuyers. There are more homes for sale and more choice is welcome news for many, but both agents and sellers need to adapt to a more competitive market where pricing and presentation really matter for those serious about moving.

Strong rebound in demand, but 9% down on last year

Buyer demand has rebounded since the beginning of the year following a quieter end to 2025. Many households delayed moving decisions amid uncertainty around the autumn Budget.

Activity levels are now broadly in line with early 2024, reflecting a return to stable demand and a more predictable environment to build your 2026 pipeline.

Demand remains 9% below last year’s unusually strong start when buyers rushed to get ahead of stamp duty changes in mid-2025.

Fierce competition in the mortgage market and lower mortgage rates are supporting confidence. The average 5-year fixed mortgage rate (75% LTV) has fallen to 4%. This is the lowest level since 2022, improving affordability and enabling more households to consider a move.

This 4% threshold is a significant psychological marker for your buying database. It could move buyers off the sidelines and back into your viewing diary, especially those who were priced out 12 months ago.

What’s more, these buyers are entering a very different market to a year ago.

The total number of homes for sale is 6% higher than last year, with estate agents marketing the largest number of properties seen in 8 years. This increase in supply is easing competition between buyers and placing greater emphasis on realistic pricing and good presentation from sellers.

UK house prices increase 1.2% over 2025

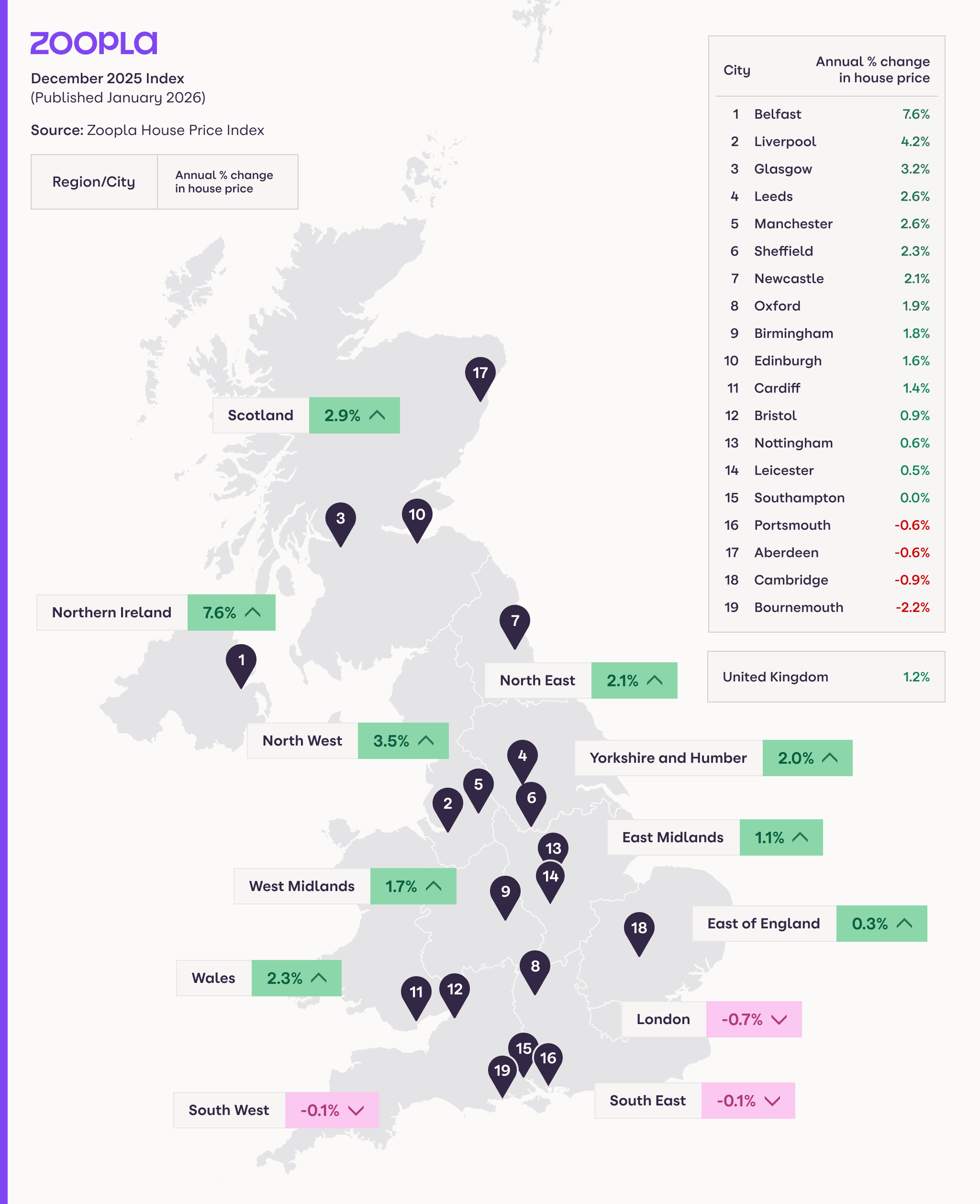

Market conditions vary across the country. The average UK house price increased by 1.2% over the last 12 months, increasing by £3,200 to stand at £269,800 at the end of 2025.

Prices have increased up to 4 times faster in more affordable parts of the Midlands, Northern England, Scotland and Northern Ireland.

In contrast, smaller price falls of -0.1% were recorded across the South East and South West regions.

Buyers in the South of England are more price-sensitive due to higher buying costs and a greater supply of homes for sale. London now has significantly more homes on the market than a year ago, reinforcing a buyers’ market in the capital and pushing prices lower over 2025.

While the national 1.2% rise is a useful headline for general confidence, the reality on the ground is far more fragmented than even the regional picture. Whether you’re defending a fee in a growth area or managing a price reduction in a more sensitive southern market, local context is the difference between a property that’s priced to sell and one that takes 6 months to move.

Average house prices by property type

| October 2025 | November 2025 | December 2025 | Annual price change (£) | Annual price change (%) | |

| All UK property | £269,700 | £269,800 | £269,800 | £3,190 | 1.20% |

| Flats/maisonettes | £191,700 | £191,900 | £191,400 | -£2,810 | -1.40% |

| Terraced houses | £238,900 | £238,800 | £239,100 | £3,910 | 1.70% |

| Semi-detached houses | £277,500 | £277,600 | £277,800 | £6,080 | 2.20% |

| Detached houses | £453,100 | £452,500 | £453,000 | £5,330 | 1.20% |

Outlook

We expect current trends in market activity to continue over the early part of the year. The desire to move is clearly there, but it’s a high-choice environment.

Success in the first half of 2026 will come down to active portfolio management – identifying the properties that need a refresh in presentation or a price alignment before they become part of the background noise.