Usual seasonal lull, as some movers wait for Boxing Day bounce

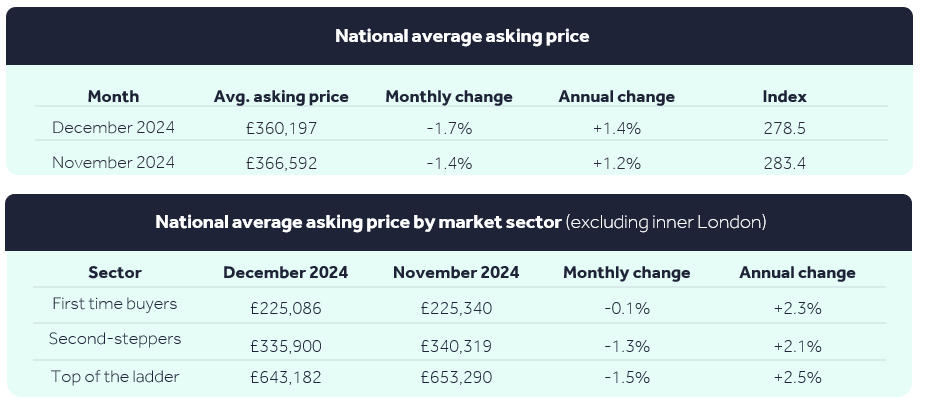

- New seller asking prices drop by a seasonal 1.7% (-£6,395) this month to £360,197, in line with the usual December monthly fall, with sellers’ pricing power diminishing as Christmas approaches:

- Prices end the year 1.4% above December 2023, and Rightmove predicts that new seller asking prices will rise by 4% next year, with forecast mortgage rate drops set to further improve affordability and stimulate market activity

- Despite the festive lull, activity remains substantially stronger than the same period a year ago, with the number of sales being agreed up by 22%, and new buyer demand up by 13%

- Some movers are now waiting for the traditional Boxing Day bounce on Rightmove:

- Boxing Day 2023 saw a record number of new sellers launching to the market for that time of year, providing fresh property choice for buyers, while buyer demand jumped by 273% between the Christmas Day lull and Boxing Day

- Rightmove’s real-time data also captures the impact of the looming stamp-duty deadline on March 31st 2025:

- Sellers of smaller properties in higher-priced areas are trying to beat the deadline to avoid higher tax

- Prices are holding up best in the first-time-buyer sector, especially homes priced below the £300,000 threshold

- Despite the signs of a stronger 2025, headwinds remain, with the impact of Budget measures being a challenge

The average price of property coming to the market for sale falls by a seasonal 1.7% this month (-£6,395) to £360,197, in line with the usual December monthly drop. Rightmove’s lead indicator of new seller asking prices measures prices at the very beginning of the home buying and selling process, capturing immediate changes in home-mover behaviour. New sellers typically need to come to market with some of the most competitive prices of the year in December, to motivate festivity-distracted buyers to act. While the market is slowing down as it always does in the build-up to Christmas, activity continues to remain strong compared to last year. This is laying the groundwork for a potentially busy Boxing Day bounce in home-mover activity, which has become a tradition in recent years as early-bird buyers and sellers flood onto Rightmove. Looking ahead to 2025, challenges remain, and Rightmove’s real-time data continues to show the impact of the looming stamp-duty deadline on March 31st. There are signs that those who are most likely to face higher stamp duty charges are trying to act fast to avoid them, despite now being very much up against the clock. Rightmove predicts that new seller asking prices will rise by a further 4% overall in 2025, aided by anticipated mortgage rate falls, which would help to stimulate activity.

The number of sales being agreed is up by 22% compared with this time last year, while the number of new buyers contacting estate agents about homes for sale is up by 13%. This momentum is a good sign for another Boxing Day activity bounce. The prospect of last year’s bounce encouraged a record number of Boxing Day sellers to launch their properties onto the market in 2023. The resulting surge in fresh choice creates a virtuous circle of market activity, attracting potential New Year buyers – last year, buyer demand jumped by 273% between the Christmas Day lull and Boxing Day.

However, despite the positive aspects of the 2024 market, the looming stamp duty deadline in England is a potential dampener for some in 2025, and Rightmove’s real-time data is capturing the impact on different groups of movers. The latest snapshot identifies signs that sellers of smaller properties in higher-priced areas are trying to trade up or just sell before the deadline to avoid the higher stamp duty charges, despite now needing to act very quickly. In the last four weeks, the number of sellers of typical first-time buyer homes with two bedrooms or fewer in London coming to market is up by 20%, the most of any regional market sector. In second place is the South East at +16%, which is also the second most expensive region. Meanwhile, prices are holding up most strongly for first-time-buyer type properties in more affordable areas, which are set to be less affected by the stamp duty changes, as most first-time-buyer homes are well under the resuming £300,000 tax threshold. Prices for typical first-time-buyer homes in the North East are up by 1.0% this month, starkly contrasting this month’s national 1.7% fall across all property types.

While there are positive signs for the 2025 market, and meaningful mortgage rate falls would be a big boost to consumer confidence and pockets, there is still caution over how next year may play out. There is uncertainty over how rising stamp duty may affect activity later in 2025, as well as the level of wage growth.